- Make Investing Normal

- Posts

- The Numbers for 2024 🤓

The Numbers for 2024 🤓

PLUS: A Surprise for ‘25 🥳

Annual Recap 2024

In this email:

The Numbers for 2024 🤓

A Surprise for ‘25 🥳

The Numbers for 2024 🤓

Men lie, women lie but number’s don’t.

Let’s have a review of the most important stats for 2024. 🔍️

My stats for 2024

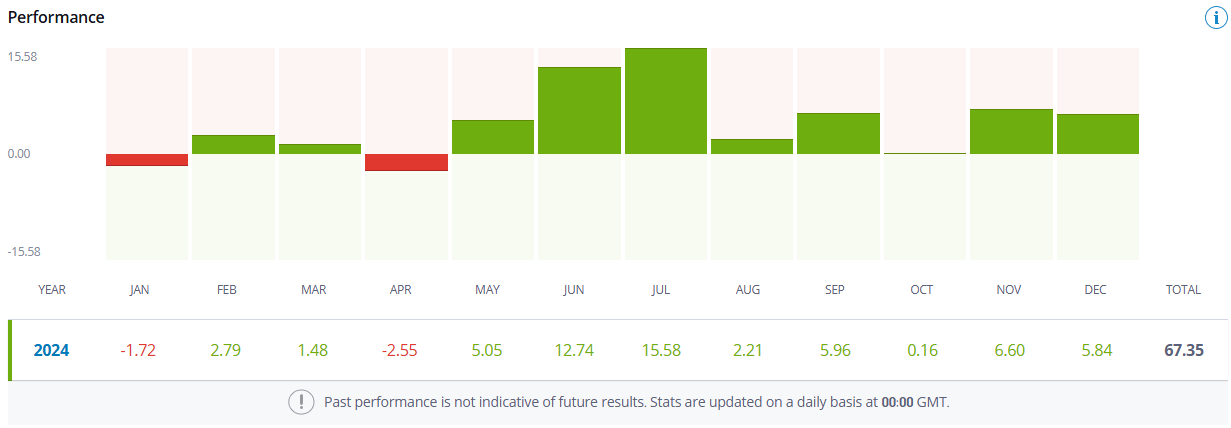

First up, I had an annual return of 67.35%. 🤯 Only 2 red months which were January & April.

Deposits & closed positions

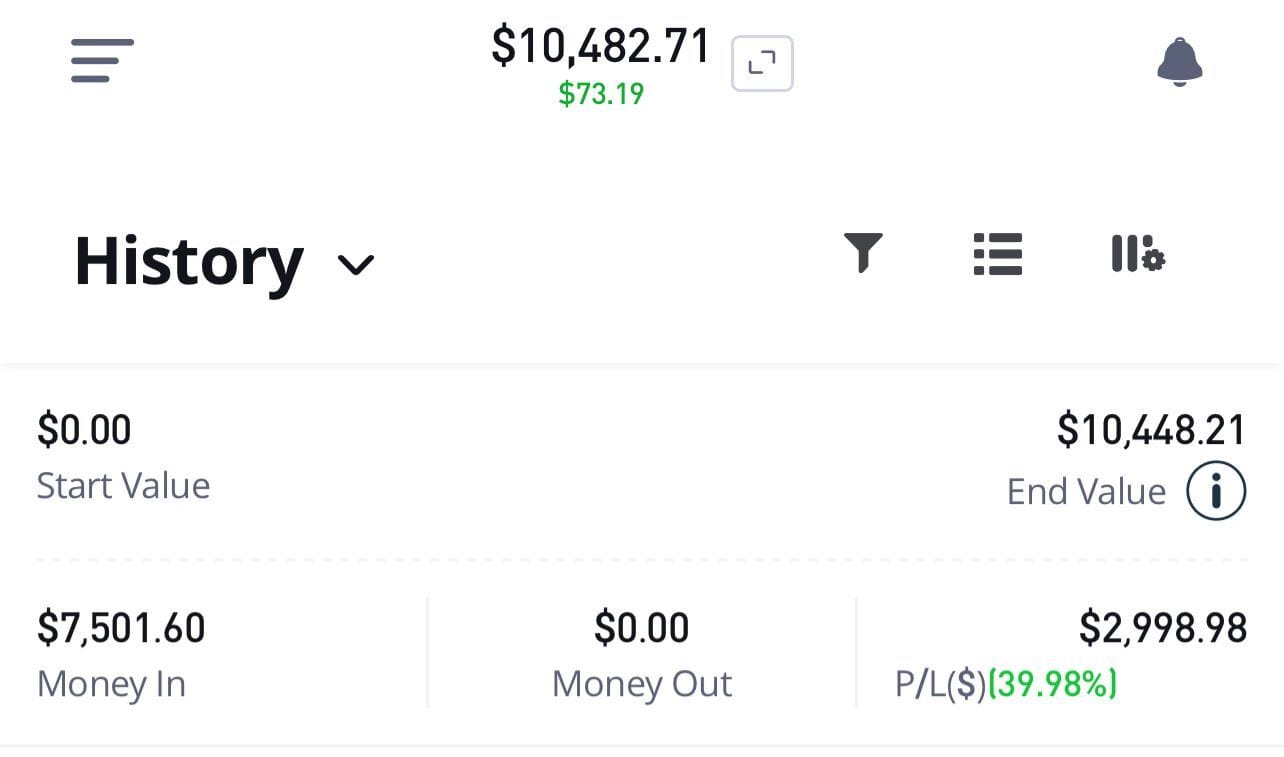

I started in January at $0. The first few deposits were $500 & it’s been $1,000 each time since.

In total, I deposited $7,501.60. Closed profits were $2,998.98, just under 40% of the account.

(FYI I’ll never deposit more than $1,000/month into this account. I want it to be about growing the account with trades rather than making monster deposits each month. I think $1,000 is the sweet spot for that.)

How comes the annual return is 67% if the closed profits are 40%? 🤔

It’s because the platform displays the stats relative to the balance. The statements don’t.

For example, if I had $1,000 in my account & had a 50% return for the month, the stats would show 50%. If I deposit another $1,000 next month, I still had the 50% return but now the statement would show it at 25% because of the new account balance.

Make sense? I hope so. 😅

My Favourite Assets 💘

We’ve got the headlines. Let’s take a closer look at where those gains came from.

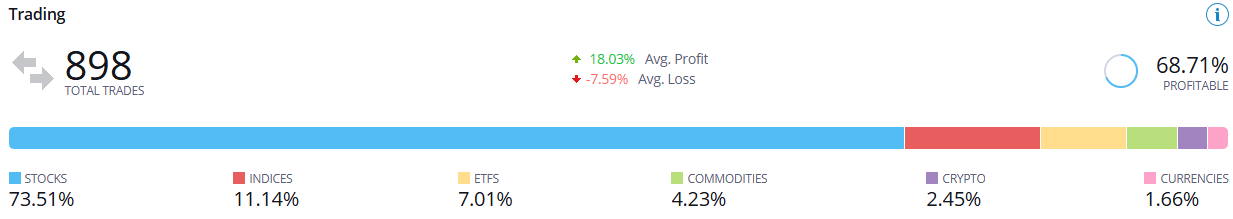

I took 898 trades in 2024. 🤯

Of those, 68.7% were profitable. The average profit was just over 18%. My average loss was 7.6%

A deeper dive into some of my trading patterns

Stocks were a heavy favourite. Here’s how many trades I took of each asset class:

Stocks - 73.51% (661 trades)

Indices - 11.14% (100 trades)

ETFs - 7.01% (62.9 trades)

Commodites - 4.23% (38 trades)

Crypto - 2.45% (22 trades)

Currencies - 1.66% (15 trades)

Most Frequently Traded

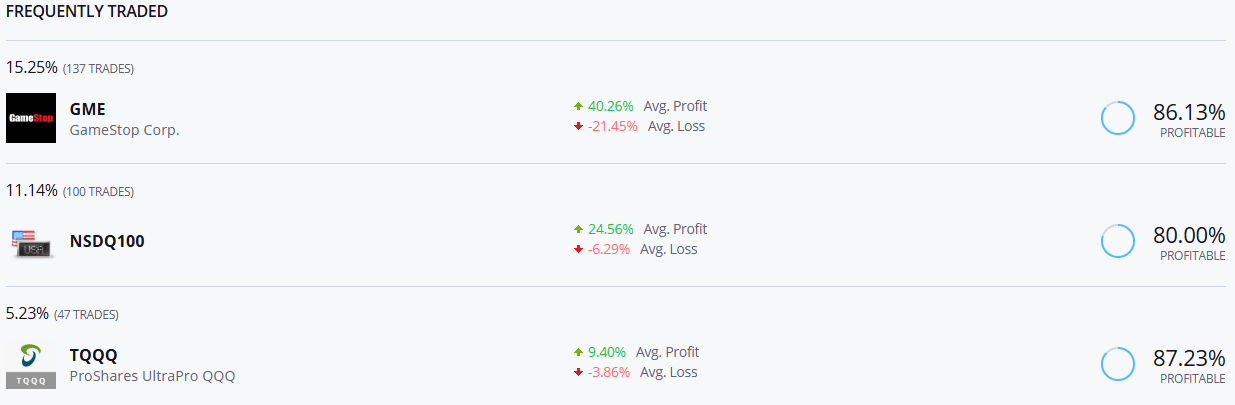

GameStop was my most traded asset. Shorting the peaks worked out well & accounted for a lot of the gains I made. GameStop is in a bit of a different position now so I don’t think it’ll show up again in 2025 on this list but who knows.

The assets I traded the most this year

NSDQ100 & TQQQ are both leveraged assets that track the Nasdaq. They’re a staple of my trading. Expect to see them podium again the future.

GameStop: Average Profit 40%, Average loss 21.5%, Profitable 86.13%. (137 trades)

NSDQ100: Average Profit 24.5%, Average loss 6.29%, Profitable 80% (100 trades)

TQQQ: Average Profit 9.4%, Average loss 3.8%, Profitable 87.23% (47 trades)

What did you think of today's update? |

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️

Reply