- Make Investing Normal

- Posts

- Fat People = Fat Profits🐷💰

Fat People = Fat Profits🐷💰

PLUS: They Sold. You Shouldn't ❌

Stocks of the Week!

In this email:

Fat People = Fat Profits🐷💰

Budget Better To Get Rich 💰️

They Sold. You Shouldn't ❌

Fat People = Fat Profits🐷💰

Wake up & smell the bacon weight-loss revolution!

Drug induced weight loss is a space that’s only getting bigger. There’s a couple of pharma giants that are massively undervalued & huge players in this space.

Let me tell you about them.

The Context 📖

You’ve probably seen the headlines like these.

The magic weight-loss drugs everyone’s talking about is GLP-1. These drugs are changing how medical professionals & common folk are thinking about weight management. Eli Lilly’s Tirzepatide (sold as Mounjaro & Zepbound) is one of the front runners.

This sector alone is expected to be a $150 BILLION industry by 2030.

The queue in the US is already out the door. 26% of US adults are planning to jump on the GLP-1 train by 2025. Insane.

Gen-Z is even worse? Better? They’re at 37% adoption.

Now for the important questions. How we cash in on this growing trend?

The Duopoly

It’s Lilly vs. Novo Nordisk.

Think Coke vs Pepsi but for weigh-loss meds instead of sugary drinks.

Between them, they control 85% of the GLP-1 market. Novo’s got a strong game with Semaglutide (Ozempic/Wegovy), but Lilly’s Tirzepatide is hoplding it’s own.

Eli Lilly’s Tirzepatide had people shifting an average of 20.2% of their body weight in clinical trials.

That means a 200lb person is shifting 40lbs on this drug.

Novo’s semaglutide helped people lose 13.7% in similar trials. That’s 6.5% less than Lilly’s. A pretty big different when you’re trying to slim down.

Novo had the benefit of getting to market first but Lilly’s been investing like a mad scientist.

Over $20 billion’s been spent on manufacturing since 2020 to catch up with demand.

If the results are that much better than Ozempic, they’d better be ready for the demand that’s about to come their way.

And they’ve got an oral GLP-1 drug (Orforglipron) coming in 2026 to capture anyone that’s squeamish of needles.

The Money Stuff

Current stock prices sits just shy of $800 but anlalysts are expecting a CAGR of 25%.

That’d put share price somewhere around $1250 by 2027 for a 55% gain. Here’s why they’ve got to that number.

A move to $1250 is reasonable & would generate a 55% gain from current price

GLP-1 drugs are printing cash. Revenue is expected to hit $75B by 2027. Net margin is expected to run at 35%.

Add in demand for next-gen drugs like Orforglipron with the fact they’re expanding into global markets (including China) & you’ve got all the ingredients for a rocket ship.

The Risks ⚠️

In a space with so much demand, it’s only a matter of time before other companies start cooking up their own recipes.

Amgen & Pfizer are in the kitchen making their own GLP-1 drugs which could take some market share. But getting drugs approved is a lengthy process.

Eli Lilly are already in the market & with the results they’ve been getting, I’m not sure how much better Amgen & Pfizer can do.

There’s also the small detail that Lilly’s patents on Tirzepatide run up until 2036 to keep competitors at arm’s length. That’s a pretty hefty head start. I don’t think I’ll be losing any sleep over this one.

Growth projections could get scrapped if there’s any delay in Orforglipron’s launch or it doesn’t perform well in trials.

Growth also assumes they can keep up with demand so there’s the worry that high demand could stretch manufacturing thin (again).

I think these risks are negligible when you look at the potential upside.

My Plan 🗺️

Eli Lilly is down 17.5% from its highs. Novo Nordisk is down nearly 40%.

Both are massively undervalued. Covering 85% of what’s set to be a $150 billion market between them, I think you’d be silly to not have them in you portfolio.

I’ve invested in both to cover my bases. Novo gets 1% of my portfolio, Eli Lilly gets closer to 2%.

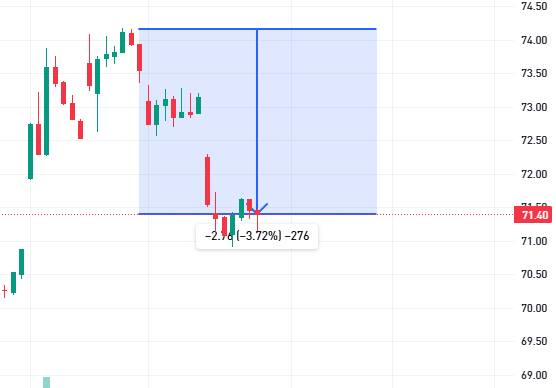

In the red but ready to average down. Still plenty of gain to be had

I’ve favoured Eli Lilly because of the stronger results in clinical trials & the fact that they’ve barely got to market with that drug. I think its perfectly positioned to lead the space.

The global expansion & introducing an oral medication also makes me feel better about parking a little more cash with them.

Is that allocation set in stone? Not at all. I’ll keep an eye on it. See who’s innovating, what’s gripping the market. But I’m happy with that for now.

Budget Better To Get Rich 💰️

See 2025 clearly with BILL + free Ray-Bans

When you’re at the starting line of 2025, you need a pair of Ray-Ban Smart Glasses to stay focused!

We’ve got you covered with a free pair on us when you take a 30-minute demo of BILL Spend & Expense.1

Choose BILL Spend & Expense to:

Automate expense reports so you can focus on strategy

Set budgets across teams to better control expenses

Get real-time insights into your company spend

Access scalable credit lines from $50K to $5M1

Ready to hit the ground running and see clearly in 2025?

1 Terms & Conditions Apply. See offer page for more details. The BILL Divvy Card is issued by Cross River Bank, Member FDIC, and is not a deposit product.

They Sold. You Shouldn't ❌

Last week’s December jobs report killed expectations. 256k jobs added vs. 155k forecasted. Great news, right?

Wrong (apparently).

The panic chucked financials in the bargain bin & I’ve found a gem in there. Citigroup.

Unexpected, undervalued, & very tempting. Let’s take a closer look.

The Sell-Off AKA The Overreaction

The market panicked because a strong labor market = fewer rate cuts in 2025.

Cue the market wide sell off. Including the financials. But here’s the thing everyone’s missing in the panic.

Citi lost nearly 4% last week after gapping up

Higher rates & a steepening yield curve are actually great for banks.

It just means banks can charge more for loans & pay less for deposits. If anything, this news should’ve send bank stocks flying.

Citigroup are one of the strongest contenders to take advantage if rates are going to be higher for longer.

Citi’s Glow-Up 💄

Excluding last week, Citigroup’s been on a wild ride the past couple years. CEO Jane Fraser has been trimming the fat & reinventing how they do things.

Bye-bye, distractions: Citi ditched non-core businesses like global consumer banking. Why? To focus on high-margin, high-quality areas like Services (a cash cow in the making). 🐄

Tech flex: They’ve been rebuilding operations from scratch. Think modern tech stack & streamlined processes for efficiency gains.

What’s next? A leaner, meaner, more profitable Citi with lower capital requirements. Higher returns & finally some multiple expansion.

Big Date Alert: January 15th 📅

I’ve got a big red circle around January 15th. It’s when Citi drop their earnings & here’s what to expect:

Investment banking fees: Up 25–30% YoY, thanks to M&A, equity offerings, & bond deals. 💼

Trading: Equities trading expected to jump by double digits.

Stock buybacks: They’re buying up $1B of their own shares this quarter.

Costs: Slightly higher than guidance, but it’s all tied to future-proofing the business. Change ain’t cheap.

Last earnings was a beat across the board for Citi. Expecting the same again.

If they can hit or exceed expectations Wall Street will wake up & smell the undervaluation. The 2.5% drop on Friday will just be a bonus discount on the new positions I add.

Riding Macro Tailwinds🌪️

It’s not just about what’s happening inside Citi. The big picture trends are giving them a boost too.

Higher-for-longer rates: Means more net interest income.

Deregulation: Trump is a wild man. He just wants his name to be associate with positive growth in the US. The new administration might ease up some banking rules. Less regulation = more capital for buybacks & growth.

The Price Target 📈

Right now, Citi’s trading below its tangible book value. That’s a fancy way of saying the stock is stupidly cheap. It’s like buying $100 bills for $90.

With the Jane Fraser transformation almost complete 2025 could be the year this bad boy hits $120+. Let’s do some quick math:

Current tangible book value (TBV): $89/share.

Projected TBV in 2026: ~$100/share.

Return on Equity (ROE): Targeting 11–12%.

Stock price potential: North of $120.

My Plan 🗺️

No prizes for guessing if this is being added to my portfolio.

Citi has set the stage for outperformance. A leaner, more focused, high margin bank that’s riding on macro tailwinds? Why would you not want them in your portfolio?

The sell off is just the cherry on top. And the diviended yield is currently sitting at just over 3%. So maybe there’s 2 cherries.

I’m making them about 1% of my portfolio on market open. If earnings is a win & everything’s going in the right direction I might add a little more.

What did you think of today's update? |

That’s all! See you same time next week 👋

P.S Hit reply & let me know what you thought of this weeks newsletter. All feedback is welcomed ❤️

Reply