- Make Investing Normal

- Posts

- A Deal You'll Regret Missing? 🤔

A Deal You'll Regret Missing? 🤔

Stocks of the Week!

In this email:

A Deal You'll Regret Missing? 🤔

A Deal You'll Regret Missing? 🤔

What does it mean when a company’s fundamentals keep getting better but the share price keeps falling?

I think it’s like finding a winning scratchcard that someone else has thrown away because they didn’t look close enough.

And that’s exactly what’s been happening to an AI powerhouse in the market. Micron Technology tanked over 45% in 6 weeks & still sitting about 40% down. Don’t let it scare you off! This drop has created one of the best buying opportunities in the market right now.

Let me tell you why!

Micron took a beating in a brutal 6 week period

Why Micron is a Top Buy-and-Hold Candidate 📈

Micron is leading the way in memory tech, especially in everyone’s favourite sector right now - AI. Despite what the recent selloff would have you believe, Micron’s fundamentals have stayed rock solid. In fact, analysts expect Micron’s earnings per share (EPS) to boom in a big way over the next few years. Projections have them penciled in for a potential $10 rise by 2025. That’s nearly ten times higher than EPS we’ve seen recently. 📊

That’d have them trading around 8-9 time forward earnings which is dirt cheap. The word bargain doesn’t even do it justice.

And AI is continuing to grow which is driving massive demand for memory & storage solutions. And you know who’s perfectly positioned to benefit from all that demand? You guessed it, Micron!

I want to be positioned to benefit from all that growth too buy having it as part of my portfolio!

Micron’s AI Story is Just Getting Started 🤖

Micron’s tech is a necessity for developing faster, more intelligent AI models & machine learning systems. That’s a great spot to be in. It means if the giants like Apple, Microsoft, Google, Amazon & Nvidia what to keep expanding in the AI space, they’ll have bring Micron along with them by spending on their memory solutions.

And it’s not just about external innovations. Micron is also using AI to refine their own operations. Smart factories are using AI to optimize production, improve yields, & enhance overall efficiency. More efficiency = reduced costs.

Theory say’s that’ll improve Micron’s profitability, too.

Solid Earnings and a Bright Future 🌟

Micron’s recent earnings report ticked another box in the “Buy” column. The company posted an EPS of $0.62, beating estimates by 17%, & reported revenue growth of over 81% year-over-year. Those numbers are great, especially when you consider the tough market conditions we’ve been seeing. They also guided to stronger-than-expected revenue for the next quarter which means Micron are backing their own growth potential. Love to see that

The Recent Dip: A Buying Opportunity 🛒

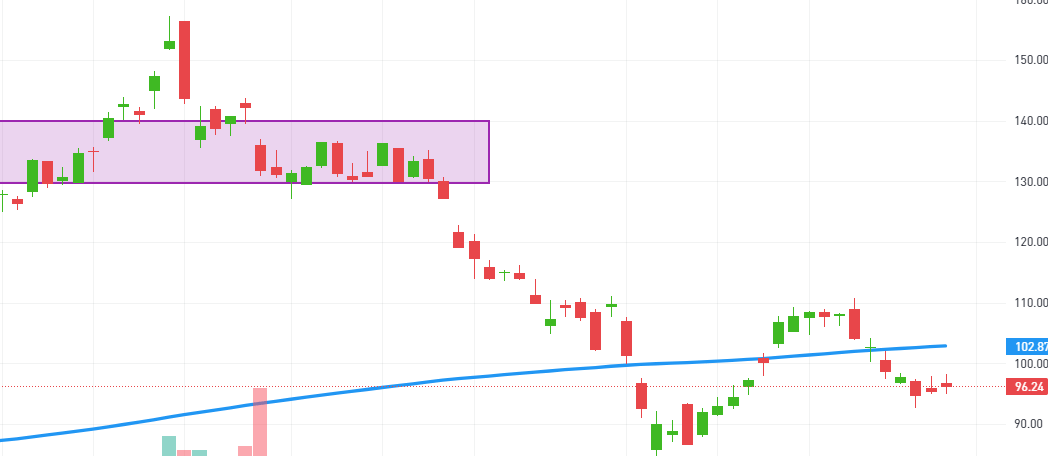

So if everything’s looking so great, what happened? Why did Micron’s stock drop so dramatically? The stock’s dropped below some key support levels & even broken below its 200-day moving average. Shouldn’t we sit it out?

Here’s the thing: this selloff wasn’t driven by any fundamental changes in Micron’s outlook - just a shift in market sentiment as a whole. When the general vibe in the market is fearful, great companies can get caught in the crossfire. This is a classic case of the market overreacting. It’s time’s like this we need to recite Warren Buffet’s mantra. Be fearful when others are greedy & greedy when others are fearful.

Price consolidated around $130-$140 before breaking to new highs & before breaking to recent lows

Even though the stock has bounced back about 5%, it’s still trading at a super attractive valuation. Analysts have price targets for Micron ranging from $110 at the low end to as high as $225. My first target is around $130 - $140 where price has consolidated quite a bit in the past & would be around a 35% - 40% upside. From there, all being well my next target would be $160 - $180 which’d be up to 86% in the green.

The Risks: What You Need to Know ⚠️

Now, nothing is this life is without risk. Micron can expect tough competition from giants like Samsung & there’s never a dull moment where China is involved. Geopolitical tensions could impact its operations there. The company’s products are also subject to price fluctuations due to market dynamics & demand which could impact earnings. For me, the potential risks don’t even come close to outweighing the potential rewards at the current price point, especially with a long term outlook.

What do you think?

Is Micron looking like a steal right now? |

Effective hair loss solutions doctors trust

Hims knows the hair loss struggle is real. That’s why they offer access to a variety of hair loss treatments for men with doctor-trusted ingredients (and have the 5-star reviews to back them up!).

Dealing with a receding hairline, bald spots, or all-over thinning? Hims has a solution that can help you start regrowing your hair in just 3-6 months**.

Start your hair regrowth journey today. After completing an intake form, a licensed medical provider will review and determine if a prescription is appropriate. If prescribed, your medication ships for free!

No doctor visits, no boring waiting rooms, and no never-ending pharmacy lines.

Try their hair loss treatments for men today (and save when you subscribe).***

*Hair Hybrids are compounded products and have not been approved by the FDA. The FDA does not verify the safety or effectiveness of compounded drugs. Restrictions apply, see website for full details. Prescription products require an online consultation with a healthcare provider who will determine if a prescription is appropriate. **Based on separate individual studies of oral minoxidil and oral finasteride. ***Actual price to customer will depend on product and subscription plan purchased.

What did you think of today's update? |

That’s all! See you same time tomorrow 👋

P.S Hit reply & let me know what you thought of today’s newsletter. All feedback is welcomed ❤️

Reply